What is exit planning?

The answer is not as obvious as you may think. Yes, exit planning does literally mean “planning your exit from a company or an investment”, but many business owners fail to grasp just how advanced and far-reaching their exit planning may need to be.

83% of Business Owners don’t have a plan or have any documentation about what that plan may be…

Exit planning myths

- A common misconception is that an exit plan is a transaction, i.e. a one-time event when you sell a company or investment. But this is simply not true. If it’s anything that can be defined in one word, it’s aPLAN and a PROCESS.

- You should keep your exit planning a secret from your employees. The one that goes something like “oh no, the boss is talking about exit planning… we’re all going to lose our jobs soon”.

If an exit plan were actually a transaction then keeping it tight lipped might be the right strategy, but it isn’t – it’s a PLAN – and most plans are a process that last a very long time, or can even be indefinite.

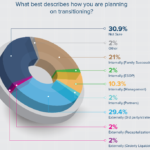

CHECK OUT HOW READY OTHER OWNERS ARE… download our infographic here:

I’ve personally experienced a situation where I thought I had to keep it a secret that I was going to exit planning seminars. I had the perception that it would cause untold problems if certain people at my firm found out. I felt like I was cheating on my employees.

The reality is, exit planning involves building future enterprise value, so getting your top leaders involved is an absolute must (whether you plan to sell to them or to a 3rd party). Everyone benefits with a unified vision!

The empowerment of an exit plan

Exit planning is simply the right way to run your business. It IS your business plan integrated with your personal and financial goals. Business is personal. Don’t ignore that part. You can either keep your business and have more flexibility, or sell your business at the highest multiple. Get your exit planning right, and you’ll be able to sell to who you want, when you want and for how much you want. But it is not as simple as defining a buying party, a date and a sale figure. There is a lot more soul searching required.

Desired outcome

When planning absolutely anything in life, you start with a desired outcome. The difficultly is working towards the right outcome, i.e. the one that focuses the plan in such a way that it can achieve the maximum number of positives. “To sell the company” is quite simply the wrong outcome in this case, but “To sell the company in order to empower me to achieve X”… now that’s more like it. Those few extra words could point you towards a fundamentally different plan than you would have had otherwise.

Different plan for different outcomes

Let’s take a look at two different goals and how it affects the outcome of your exit planning:

Outcome 1.) “I want to sell the company for the highest sum of money possible so I can be wealthy in retirement and live the same lifestyle.”

Outcome 2.) “I have enough money outside the business and I want to exit the company by handing it down to my family while paying the least amount of taxes.”

So what is the major difference?

- In the 1st scenario you may want to produce figures that maximize the value of the asset, i.e. look for a strategic partner that would benefit by operation synergies and have the ability to cut payroll and redundancies.

- In the 2nd scenario you may try and achieve the complete opposite goal in order to minimize the tax liability on the family estate. Perhaps we’d also recommend the nominal sale of the company’s ‘non-voting shares’ to a trust so the family can qualify for the 30% tax discount the IRS offers to private businesses based on lack of marketability and control.

More importantly, you should plan for both of these outcomes because things change and you need to look at every avenue as an option. Your exit planning should be dynamic and ever evolving. And you might be doing it for years beforehand. The ultimate goal is to give yourself options for when the time comes.

The 11th hour is usually too late

If an offer to buy your business comes out of the blue, you can’t suddenly work backwards to make it more valuable. You can’t redistribute the shares, you can’t route the profits overseas and you can’t just magic-up that tax-efficient trust fund or investment vehicle.

The earlier you’re on this, the better. Start planning yesterday.