Google maps is one of the most powerful tools on the planet… but it is literally worthless if you don’t plug in point B…. you need to know where you want to go!

At our very core to who we are, entrepreneurs love control, freedom, and the ability to be the director of our own narrative. Owning a business and putting the vision together, reviewing the quarterly financials and profit statements, and being clear with where your business is going allows you to be the master of your own universe.

What happens if you shift the question and ask where is your life going and how does the business fit into that plan? You need to have a plan or a guide that aligns your business and life goals together. To do one without the other just doesn’t make sense.

The goal is to increase the value of your business, work less, and use the company to live the life you want by creating passive, lifetime cash flow. Your business should be a tool to accomplish your life’s passion and purpose.

What map is guiding your plan?

The 1st step in building any plan is understanding where you want to go. The quote from the book Finish Big by Bo Burlingham sums it up perfectly… “You need to know who you are, what you want from your business, and why.” Once you do this introspective work you can build the foundation of what you want out of your life.

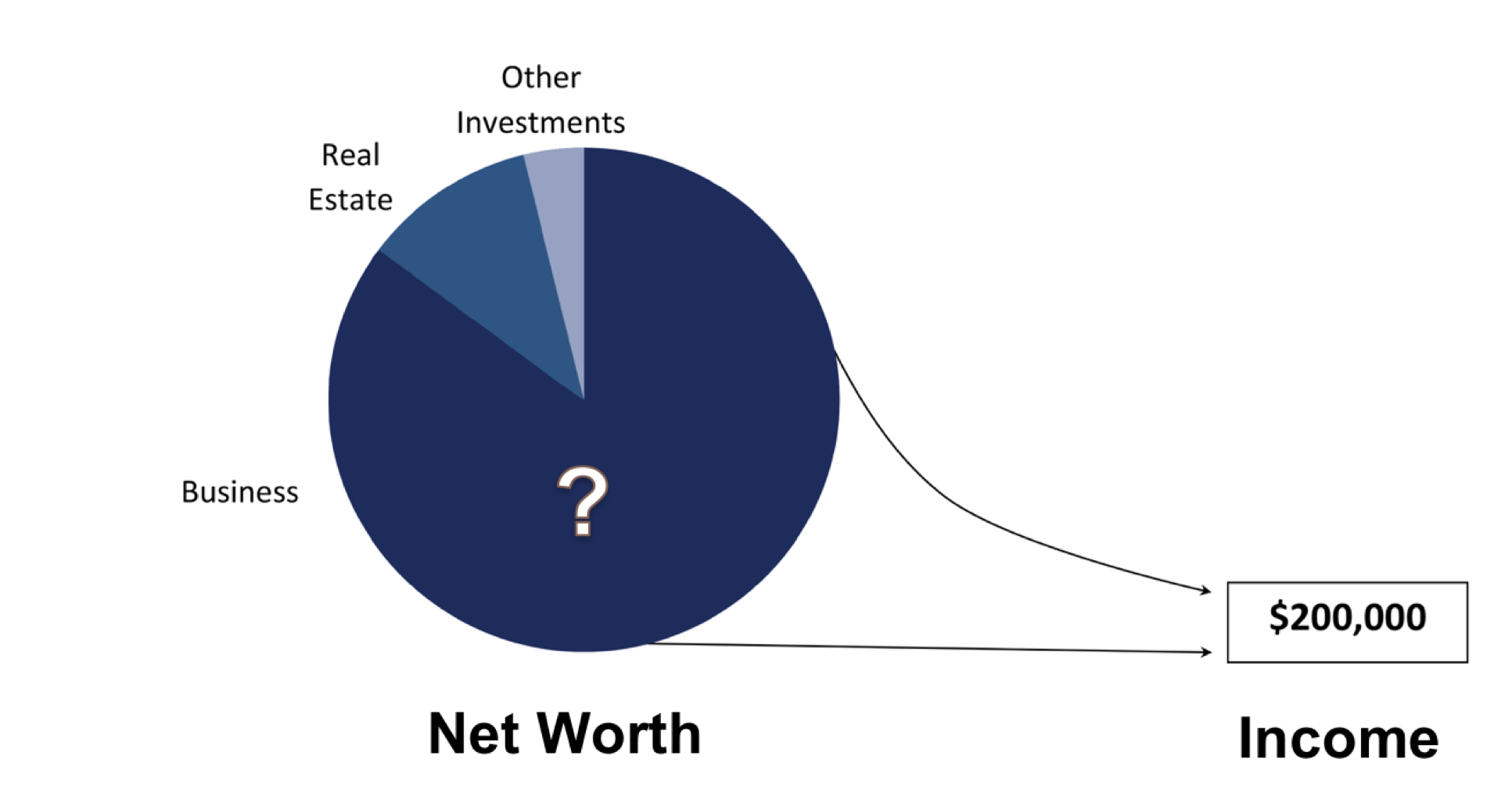

The 2nd step in the process is to know your numbers. You need a score card that can measure your progress and show you where you are and where you need to go. Below is a picture that should be your financial scorecard:

Once you’ve looked at the scorecard, these are the questions you need to ask yourself:

- What does it take in annual income to live the lifestyle you want? (including all the management perks and expenses you run through the business)

- What is the value of your company?

- How much is your company worth today net of taxes, fees, and debt after the sale of your company?

- How much longer do you want to be in the business?

- What would be your desired exit path?

- How would your exit option affect your timing and net dollar amount?

- What do you want to do in the 2nd half of you life?

The Value Advantage™ is being able to exit today to who you want, the way you want, for the dollar amount you want AND still be able to maintain your annual income and lifestyle. The advantage happens when you have “walkaway ability” (the freedom to keep the company because you didn’t like the potential buyer or terms that were laid down in front of you).

You have options to do what you want because you have created a valuable business that others want. This gives you time, money and options to rediscover who you are and what you want to do for the rest of your life. You can exit in whatever fashion that makes you happy with the ability to have a life after business with passion, purpose, and community.

Getting back in control

Therefore, once you get your baseline numbers, knowing when to sell and which exit option will suit you the best couldn’t be easier. If you approach it using the method above you effectively plan your own exit, potentially years before it actually happens. There is no longer that panic – that sudden moment when you wake up and you think you want to get out but don’t know if it’s the right time…. it’s all mapped out for you.

Calculating your Value GAP

For example, if your net proceeds from a sale today would be $4m and you assume you’re able to earn 4% annually from that; that gives you $160,000 every year afterwards. But what if you need $200,000?

In that case, in order to be financially secure, the ‘right time’ to sell is not now. So when? One answer could be “whenever the company value rises to $5m”. Another answer could be “in two years’ time, because by then I will have earned enough income from the business to boost my savings high enough to give me that $200,000 future income”.

Ways to bridge the Value GAP:

- Work longer and save more to increase your net worth

- Increase the value of your company

- Increase your net proceeds through your exit

- Who you sell to and how the deal is structured

- Estate and tax planning

Build that value

Regular readers will know that we don’t need much of an excuse to talk about the value builder system pioneered by our good friend John Warrillow… but that’s because it works! Rather than sitting back and letting time pass in the above scenarios, you might be able to restructure your business to increase its value without it having to achieve any more profit. A 5-year exit plan might just become half that if you get this right.

Understand and know where you are at in the 8 Key Drivers of Business Value:

- Financial Performance

- Growth Potential

- Switzerland Structure

- Valuation Teeter – Totter

- Recurring Revenue

- Monopoly Control

- Customer Satisfaction

- Hub & Spoke

Plan that estate

Do you actually need the net proceeds you think you needed? As important as all of the above may be, you should be just as forensic with your income and expenditure outside of your business as you are for your income and expenditure inside of it. Just like how an exit planner could be the key to hitting your magical net proceeds figure; the right advice on the rest of your estate could bring that magical figure down significantly.