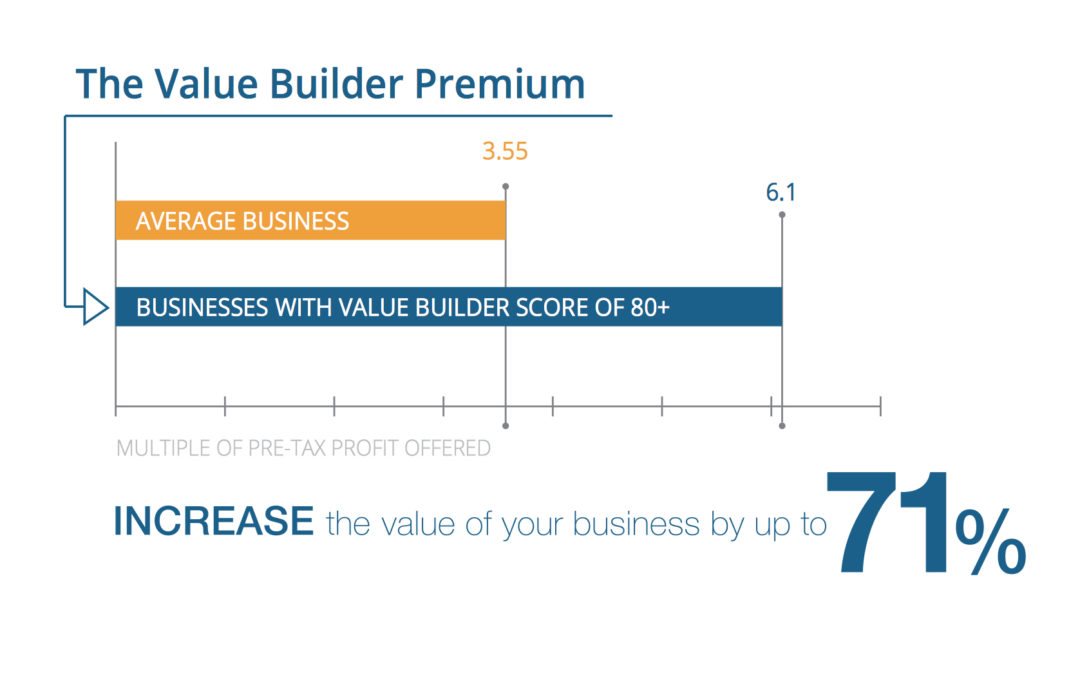

What would a 71% increase look like for you?

Yes, it is possible to ramp up the value of your business by simply understanding where your revenues come from. Get this right and your business can be worth way more than another business with exactly the same amount of profit and revenue.

How?

It all boils down to risk. The higher the risk that your business cannot generate the same amount of revenue in the future as it does now, the lower the value. Our infographic below outlines some of the key risk factors in this equation. It’s not just the amount of revenue, it’s the kind of revenue that really counts.

Turn risk into value

While it may seem unjust that one company in our example is worth 71% less than another company that turns over exactly the same amount of revenue, there is some very sound logic behind this valuation. And the good news is, the risk factors that might drag down the value of your business are the very same factors that can increase the value of your business if you get a hold of them and manage them properly. These ‘factors’ are the value drivers of your business.

What a “value driver” really means

So when we use the term “value driver” we are always referring to something that can drive value both positively and negatively – it’s very important to understand this before anything else. Our friend John Warrillow has defined 8 different value drivers in his program called The Value Builder System™ (and if you like videos even more than words you can find them here). This is the formula that underpins all of what we are saying in this article.

Taking ownership vs. taking a break

In the game of Company A versus Company B in our infographic, the company with the higher value is going to be the one where the owner has delegated the most important tasks to his or her management teams. Quite simply, if your company can already run effectively without your own day-to-day involvement, it’s worth more to a buyer… J[clickToTweet tweet=”Just ask yourself, would you want to buy a JOB or an INVESTMENT that kicks off 25% cash on cash?” quote=”Just ask yourself, would you want to buy a JOB or an INVESTMENT that kicks off 25% cash on cash?”]

A prospective buyer wants to see a client/customer base and a management structure that isn’t dependent on the soon-to-be-departed owner(s).

Plan ahead and turn risk into value

Maybe some owners who are heavily involved day to day are actually replaceable, but when it comes to buying a business, ‘maybe’ equals ‘risk’, so this will automatically harm the sale value. This is an absolute prime example of how a business can increase its ultimate sale value by planning ahead. It’s no magic formula or complex financial model – it’s as simple as recognizing where the risks lie and doing something about it. In the above example that would mean hiring staff capable of managing the owner’s workload which, although costly to the business in the short term, could turn out to be vital when it comes to the sale.

Building value is a matter of time

If you look at the infographic below you can see just how much of the good practice in the right-hand column is easily achievable. It can’t happen overnight, but if you start preparing your business for sale long before you actually need to sell, you have enough time to turn risk factors into positive value drivers.