by Ryan Tansom | Mar 8, 2017 | Blog Post

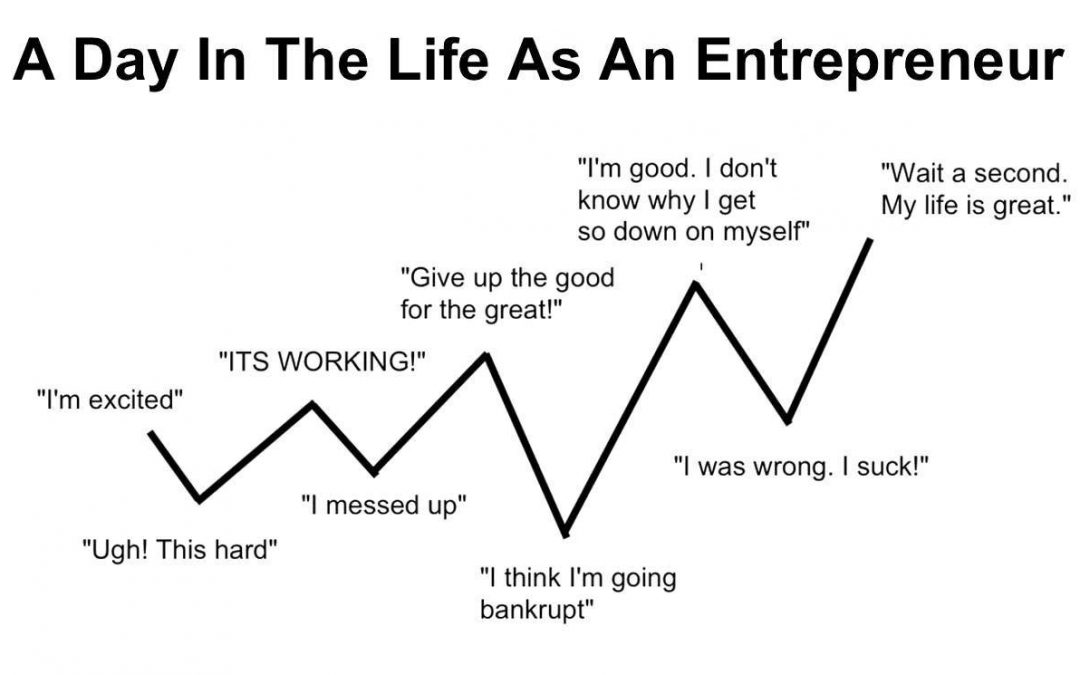

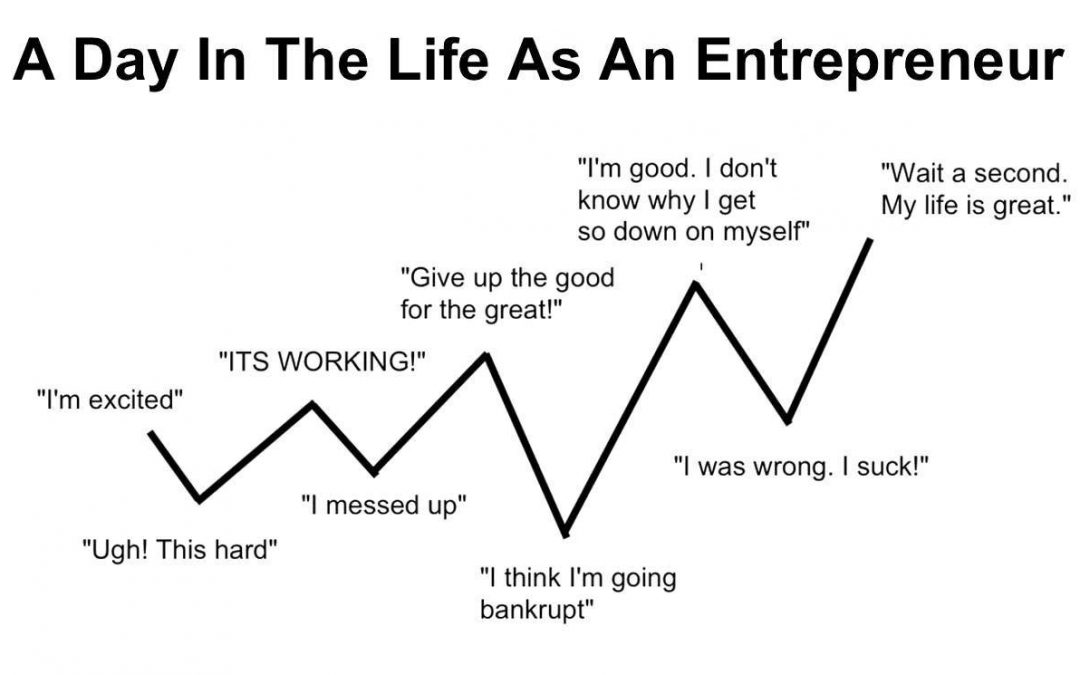

After you risk everything, fight the emotional and financial battle, and make it into the 10% of businesses that survive the startup phase, you find out it can be very lonely! This graph (by Derek Halpern, founder of Social Triggers) portrays the roller coaster of emotions an entrepreneur goes through probably on a daily basis. The million dollar question is: Who do you turn to for advice while you’re on the ride?

Who understands what you’re really going through? Most of your family and friends don’t know what it is like to have the bank or clients breathing down your neck on Tuesday before payroll. Where can you turn for a listening ear that DOESN’T have a vested interest in swaying your decision? (more…)

by Ryan Tansom | Mar 1, 2017 | Blog Post

When you’re selling to a strategic buyer rather than a financial buyer, you have to adopt a different mindset. The deal is not always based on a multiple of EBITDA and it’s not always just about negotiating the best price. There are some obstacles along the way that could cause you a long-term headache, especially if the deal doesn’t go through!

Understand your buyer

First, we should outline the basic differences between a financial buyer and a strategic buyer. Most financial buyers will use a multiple of EBITDA to come up with a valuation of your business. Buyers in this category consist of venture capital firms, hedge funds, family investment offices, and ultra high net worth individuals. The main goal of a financial buyer is to make a return on investment and EBITDA is not the only factor but is the main driving force behind most valuations.

With a strategic buyer on the other hand (more…)

by Ryan Tansom | Feb 21, 2017 | Blog Post

Before you even answer the question above, think about what it means to be exponential… does the cliche phrase, “hockey stick growth” come to mind? You’re probably thinking: “what does this have to do with me, my company or industry?” Well, a lot! In today’s fast past, information-driven economy, competitors are going to come from every corner (or basement)!

Just think, a book company (Amazon) is now competing with grocery stores, trucking companies, data centers, music companies, the film industry, tablet companies, and the list goes on…

The reason this is important to you: if you are dragging your feet to put together a 5-7 year exit plan, how confident can you be that your company (or industry) will even be relevant in the coming years EVEN IF you put together a perfect exit plan?

(more…)

by Ryan Tansom | Feb 15, 2017 | Blog Post

Life after business doesn’t have to mean you sever ties with your business all together. The Question doesn’t have to be “To Sell, or Not to Sell” In fact your current business could be vital to your next phase in life, or your ‘second half’ as our friends at the Halftime Institute call it. If you want a change, there is a lot more you can do than simply putting your business up for sale and there is a ton of introspective work you should do prior to making any of your decisions!

Your business is so much more than a financial asset – it is a platform – and from this platform you can build yourself a whole new future. (more…)

by Ryan Tansom | Feb 8, 2017 | Blog Post

Do you know what your company earns before taxes, interest, depreciation and amortization? If you don’t know, or it would take time to get to the exact number, your potential buyer or banker has the upper hand in any negotiation! You need to know your EBITDA number so you can create a narrative around why it is what it is. Without that narrative, you do not have any type of leverage and the buyer doesn’t have the full story.

(more…)

by Ryan Tansom | Feb 1, 2017 | Blog Post

Google maps is one of the most powerful tools on the planet… but it is literally worthless if you don’t plug in point B…. you need to know where you want to go!

At our very core to who we are, entrepreneurs love control, freedom, and the ability to be the director of our own narrative. Owning a business and putting the vision together, reviewing the quarterly financials and profit statements, and being clear with where your business is going allows you to be the master of your own universe.

What happens if you shift the question and ask where is your life going and how does the business fit into that plan? You need to have a plan or a guide that aligns your business and life goals together. To do one without the other just doesn’t make sense. (more…)