Do your customers pay you right away!?

Recently I spoke at a conference and I said to the audience: “raise your hand if your customers use you as a bank”. You can probably guess just how many people in the room had their hands in the air!

Customers end up using you as a bank because you let them.

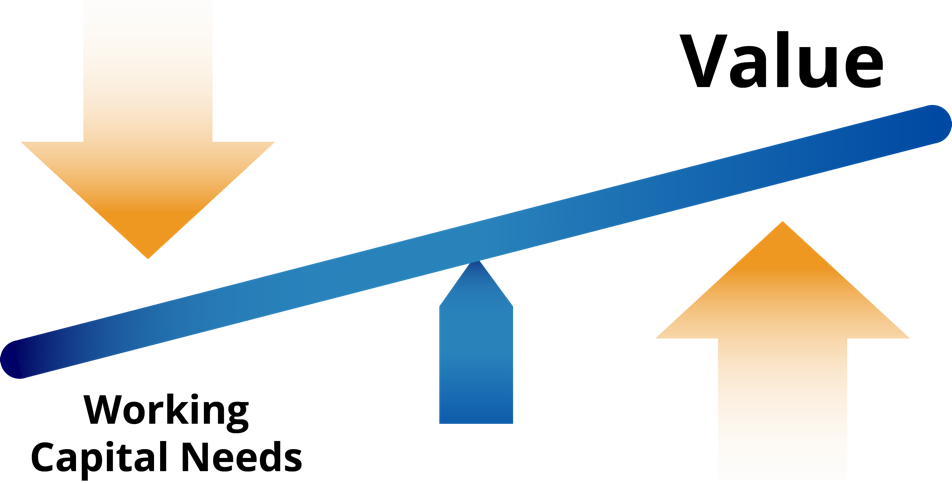

Not only does this impact normal day to day operations but it increases your need for capital to cover the expenses during the time it takes your customers to pay. This can be a nuisance, but what really hits home is how this directly affects the value of you business and how much money you take home when you sell!

It doesn’t matter how small or big you are – it’s all about communication and expectations. These are driven by priority, and if you don’t prioritize this it will negatively affect how much money you get at the end of the day.

Working capital defined

This could be made up of the line of credit you have from the bank, the lag time between selling your product/service and your customers paying for it, lines of credit from your suppliers etc. The ratio for identifying your working capital health is this:

Working Capital = Current Assets – Current Liabilities

It really boils down to this… how much money does it take to RUN your company. If it takes a lot of money to run your company, or you are below a 1 in the above equation, than the short-term financial health of your company could be at risk. The reason it matters to a buyer is because if they need to write a $5 million check and $2 million goes to working capital, that means they can’t go invest that somewhere else.

If you want a brush up on the inner workings of working capital, Investopedia has a great definition and video HERE.

How does working capital affect your take-home check?

There are two checks that a buyer will write when they buy your company. One is to you as the owner; the other is for the working capital. A $5 million outlay for the purchase of your business might be $3 million in your pocket and $2 million to cover a working capital deficit.

Why is this important? After all, once the business is gone, you won’t need to worry about the working capital. Well you should, because every dime of that your $2 million working capital is reduced is another dime that could have gone into your pocket.

By making your business as lean as possible before you sell, not only will you enjoy increased operating profit and cash flow, you’ll be creating a cash machine that anyone would want.

Take control

The first step towards taking control of working capital is to get a proper hold of how long it takes your customers to pay you. Yes, obviously, your business will be doing that with every customer when they get on the phone and chase the invoices, but it’s worth taking a top-level view and taking an average of the whole picture. Is it 15 days, 30 days, or even 60 days?

A simple equation will give you an idea how long it takes on average for your customers to pay. It is known as “Days Sales Outstanding”.

- Take your total number of sales in a given period (month of july for example) and then take the total amount of sales you did in that month and divide that by the amount of revenue that is outstanding. Take that number and multiply it by the number of days in that period. This will give you your average for that period.

Dangle that carrot

Once you’ve done that, it’s time to think laterally about how you can bring that figure down. Simply chasing your customers more aggressively just ain’t gonna cut it – it has to be a better plan than that. Think more about the carrot than the stick – it’s all about making it easier for them. How about some kind of smart EDI system or even a plain-ole’ credit card? I can remember being able to cut my company’s working capital by a huge amount by simply getting the client to pay our invoices on a credit card which we had agreed to pay half the fees for. An even simpler incentive might be to offer a discount for early payment.

Turn the tables

Then think about how you can pay your bills later. Just like above, it’s about working with people rather than seeing it as a game where there is a winner and a loser. How about trying to renegotiate your credit line with a supplier to be the same terms for net 30 as they’re currently giving you for net 15?

Make working capital really work for you

John Warrillow in The Value Builder System always gives the example of what Harley Davidson did. Constantly dogged by the lag time between buying their parts, manufacture, distribution and eventual sale; they wiped out a big working-capital deficit with an ingenious plan. They created the Harley Owners’ Group (“the HOGs” as it’s commonly known) which quite simply meant that they were able to raise an annual sum of $45 per member to get special insights on local rides without having to even make anything. Before you know it, a million people sign up and suddenly their working capital is looking healthier to the tune of $45 million.

The holy grail

The ultimate goal is that your revenue and gross profit covers all operational expenses so no additional outlay is required for working capital. This may not always be possible, but the closer you get to it, the more your business will be worth.

* If you want to hear a story about how a woman created a cash machine out of her company by taking her working capital from MILLIONS down to roughly 0 dollars… then listen to our Podcast episode with Kathleen Ferry HERE.